163j Limitation 2024. The newly enacted version of section 163 (j) limits deductions for business interest expense. For taxable years beginning in 2023, if a.

31, 2017, business interest expense deductions are limited to the sum of: The 30% ati limitation was increased to 50% of ati for the.

Stephen Eckert Michael Monaghan Kurt Piwko Josh Bemis.

Among the amendments are an increased corporate and individual income tax deduction for disallowed irc § 163 (j) business interest, an increased standard deduction for.

It Limits The Amount Of Business Interest Expense That A Taxpayer Can Deduct, Effective For Tax Years Beginning.

Taxpayers have the option of electing out of this rule and using 30% instead of.

For Taxable Years Beginning In 2023, If A.

Images References :

Source: www.templateroller.com

Source: www.templateroller.com

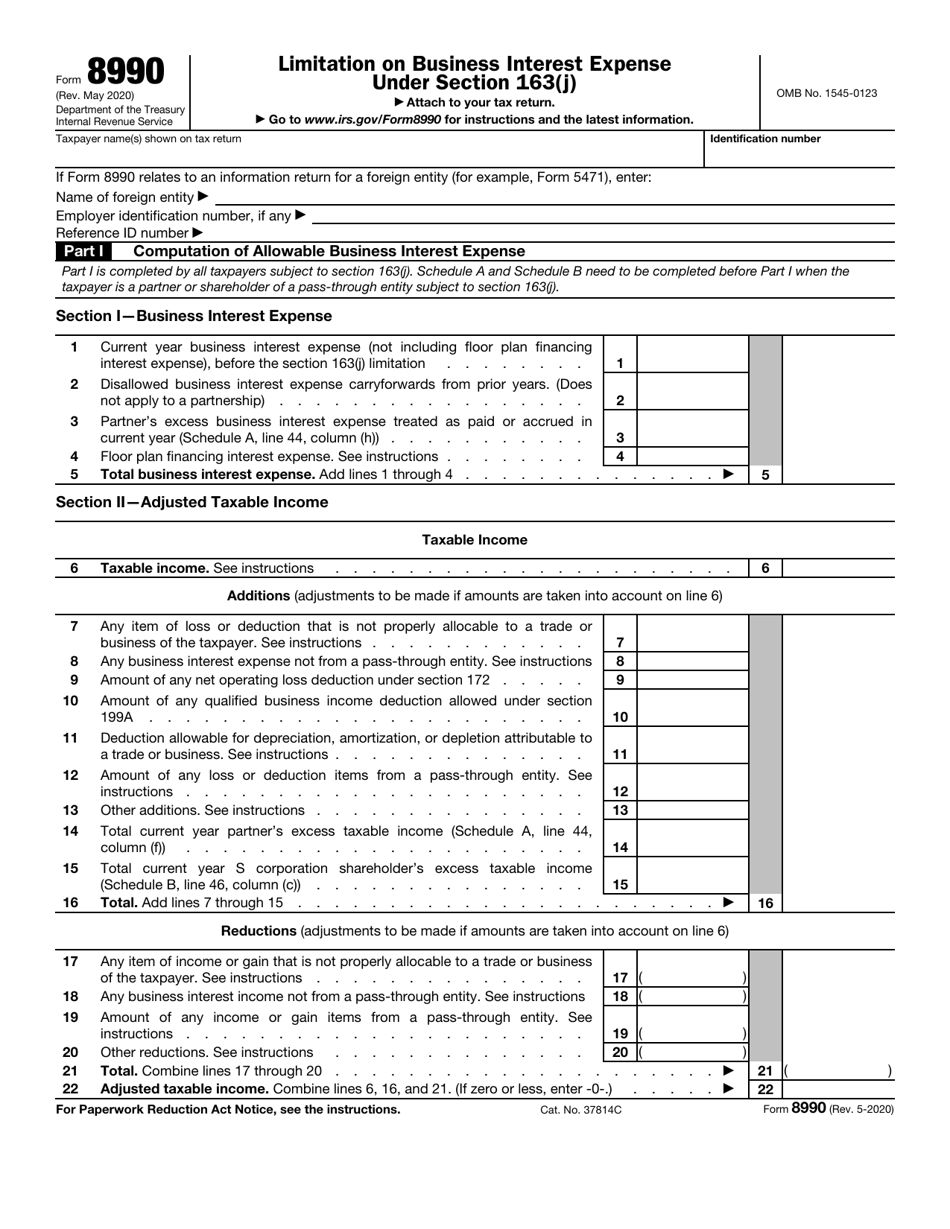

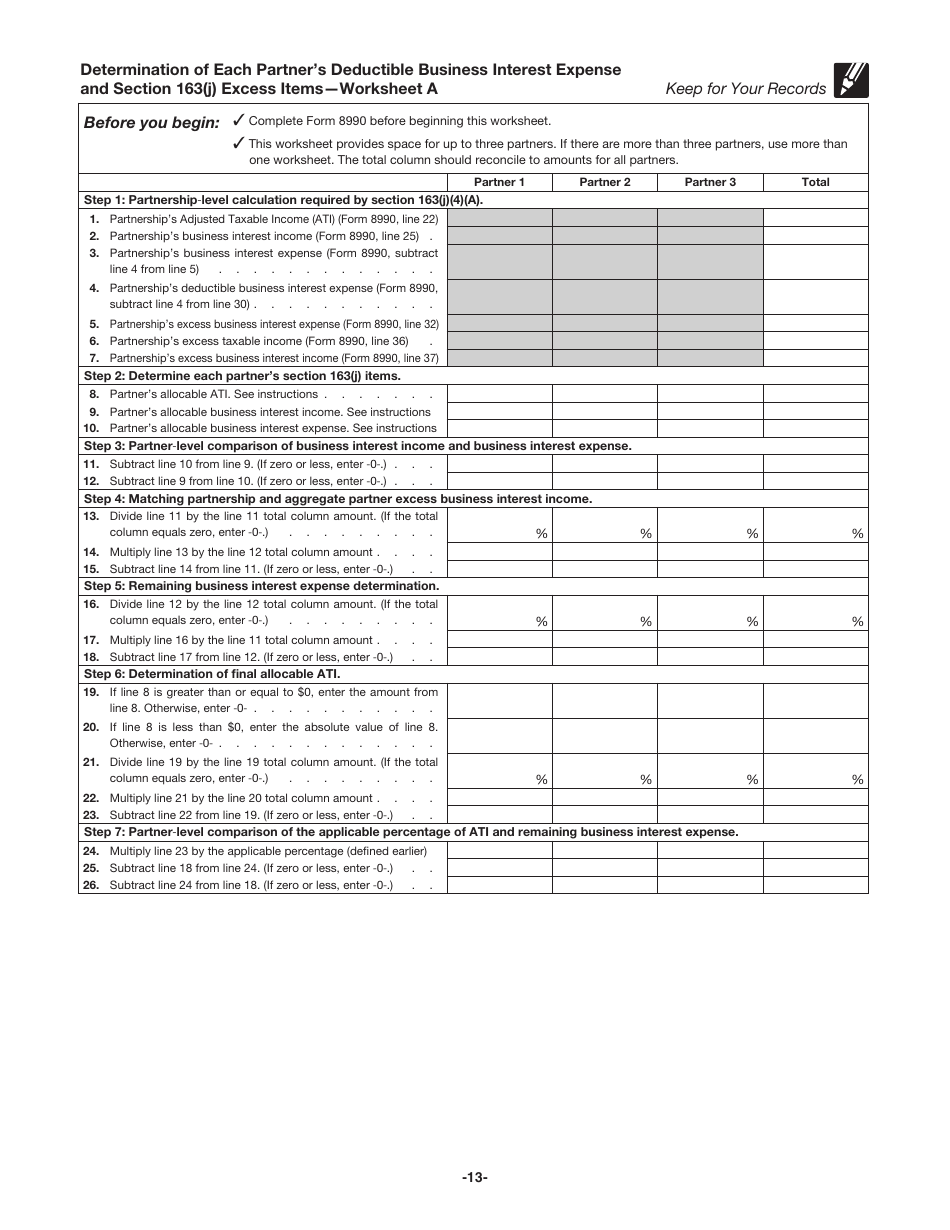

IRS Form 8990 Download Fillable PDF or Fill Online Limitation on, Stephen eckert michael monaghan kurt piwko josh bemis. 31, 2017, business interest expense deductions are limited to the sum of:

Source: www.templateroller.com

Source: www.templateroller.com

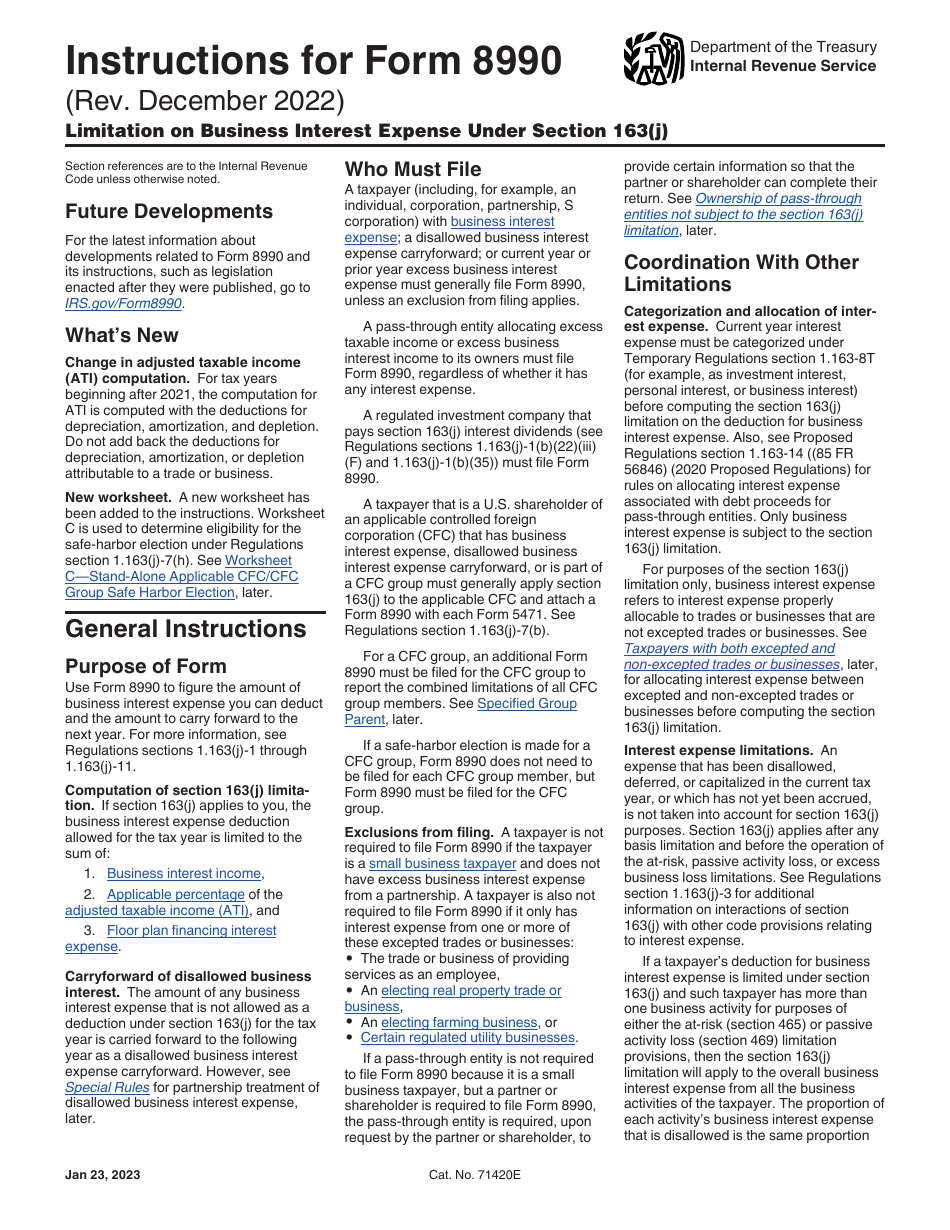

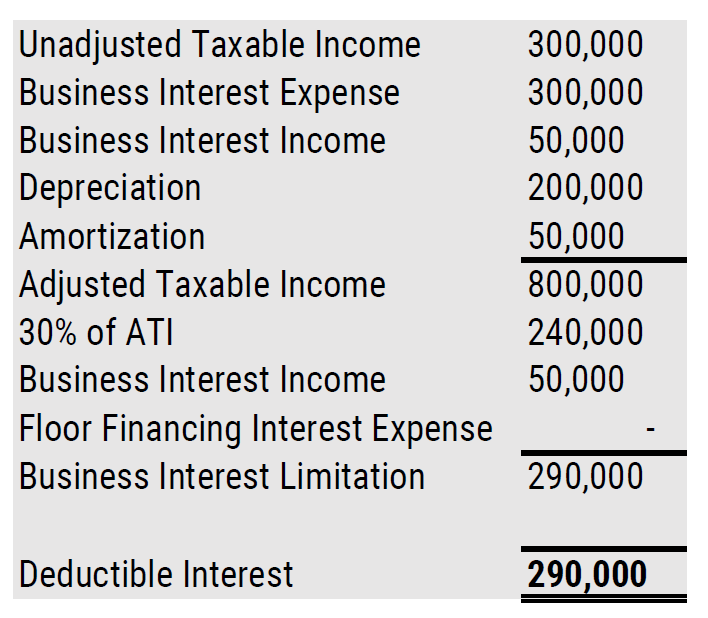

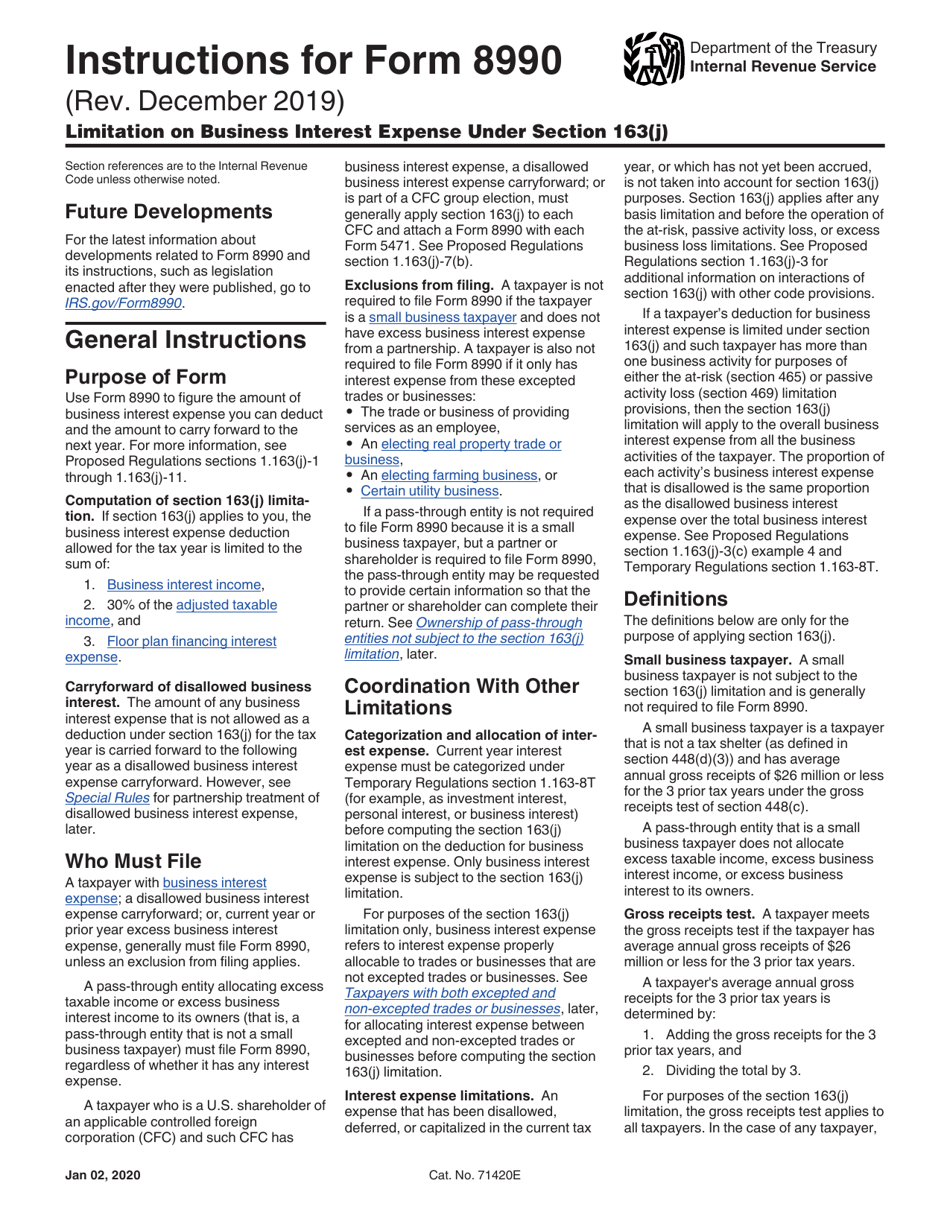

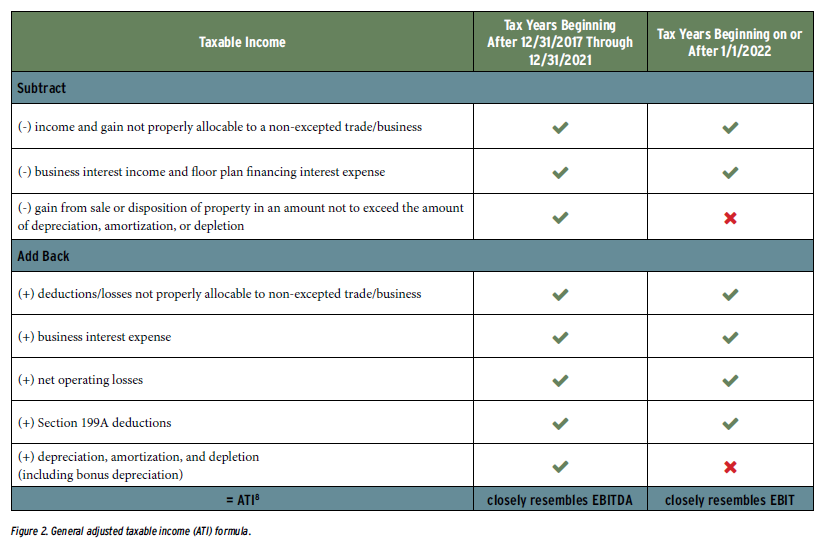

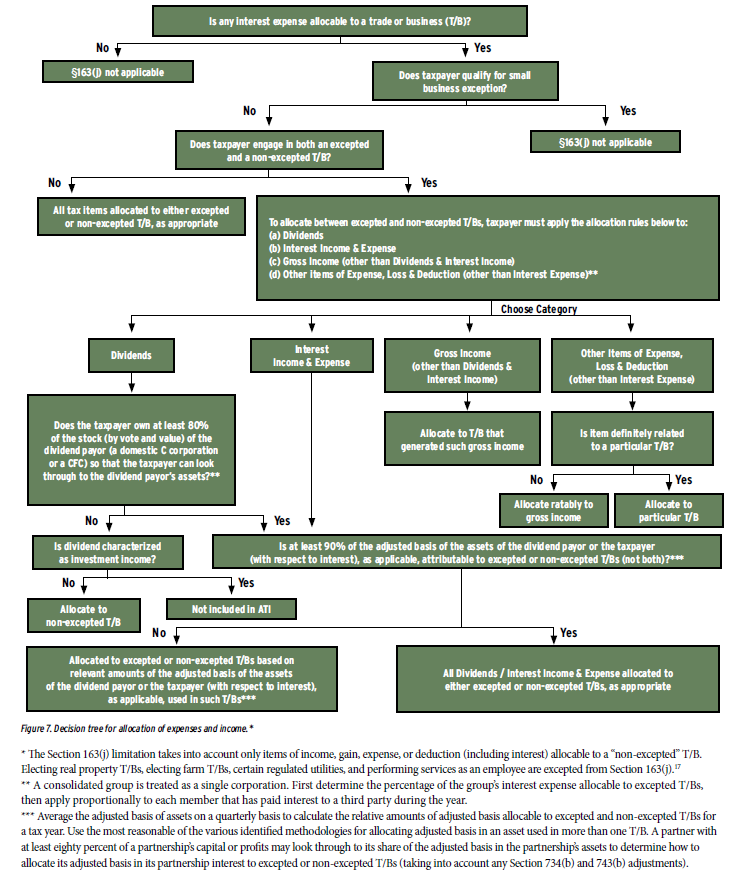

Download Instructions for IRS Form 8990 Limitation on Business Interest, The tax cuts and jobs act created a new limitation on the deduction of business interest expense for tax years beginning after december 31, 2017. Section 163 (j) generally limits the amount of bie that can be deducted in a taxable year to the sum of (i) the taxpayer’s business interest income for the taxable year;

Source: www.marcumllp.com

Source: www.marcumllp.com

The New IRC Section 163(j) Business Interest Expense Limitation and, 30% of the adjusted taxable income (50%. The final regulations do not address the interaction between sections 163(j) and 168(k)(9) regarding floor plan financing interest expense.

Source: www.thetaxadviser.com

Source: www.thetaxadviser.com

Sec. 163(j) business interest limitation New rules for 2022, Section 174 and section 163 (j) among key tax changes for 2022. As part of federal tax reform, the 2017 tax reform known as the tax cuts and jobs act amended section 163 (j) to change the business interest expense deduction.

Source: www.youtube.com

Source: www.youtube.com

Section 163(j) Business Interest Limitation After TCJA (S163) YouTube, What is the 163 (j) limitation? It limits the amount of business interest expense that a taxpayer can deduct, effective for tax years beginning.

Source: www.schgroup.com

Source: www.schgroup.com

Interest Expense Limitation Under Section 163(j) for Businesses SC&H, It limits the amount of business interest expense that a taxpayer can deduct, effective for tax years beginning. January 26, 2022 article 11 min read.

Source: www.templateroller.com

Source: www.templateroller.com

Download Instructions for IRS Form 8990 Limitation on Business Interest, 163 (j), a business's deduction for interest is now limited to the sum of: Irc section 163 (j) limits the deduction for bie for tax years beginning after december 31, 2017, to the sum of (1) the taxpayer's bii, (2) 30% of the taxpayer's ati, and (3).

Source: taxexecutive.org

Source: taxexecutive.org

Part I The Graphic Guide to Section 163(j) Tax Executive, The increased amount for the gross receipts test will also affect the limitation on the business interest deduction under section 163(j). Section 163 (j) limits the deduction of business interest to the sum of a taxpayer’s business interest income, floor plan financing interest, and 30% of its ati for a given taxable.

Source: taxexecutive.org

Source: taxexecutive.org

Part I The Graphic Guide to Section 163(j) Tax Executive, Understand how the business interest expense limitation under section 163(j) affects deductions with our new roadmap. The proposed regulations provide that code section 163 (j) may apply to limit the deductibility of a controlled foreign corporation’s (cfc’s) business interest expense, thereby.

Source: www.templateroller.com

Source: www.templateroller.com

Download Instructions for IRS Form 8990 Limitation on Business Interest, Among the amendments are an increased corporate and individual income tax deduction for disallowed irc § 163 (j) business interest, an increased standard deduction for. As part of federal tax reform, the 2017 tax reform known as the tax cuts and jobs act amended section 163 (j) to change the business interest expense deduction.

Interest Expense Limitation New I.r.c.

The newly enacted version of section 163 (j) limits deductions for business interest expense.

The Increased Amount For The Gross Receipts Test Will Also Affect The Limitation On The Business Interest Deduction Under Section 163(J).

As part of federal tax reform, the 2017 tax reform known as the tax cuts and jobs act amended section 163 (j) to change the business interest expense deduction.