Inherited Ira Rules 2025 For Spouses. Inherited iras follow the same. Inherited iras are generally subject to required minimum.

Before 2020, if you inherited an ira and you were a designated beneficiary, you could do what was called a stretch ira, or an extended. Keep as an inherited account.

Spouses Who Inherit Traditional Iras Can Continue To Use The Stretch Ira Strategy, Basing Withdrawals On Irs Life Expectancy Rmd Calculations.

Can take owner’s rmd for year of death.

Reduce Beginning Life Expectancy By 1 For Each Subsequent Year.

The new rules don’t apply to spouses who inherit an ira—that is a whole different set of rules.

Inherited Ira Rules 2025 For Spouses Images References :

Source: kayqsibelle.pages.dev

Source: kayqsibelle.pages.dev

Inherited Iras 2025 Alene Aurelie, Spouses who inherit traditional iras can continue to use the stretch ira strategy, basing withdrawals on irs life expectancy rmd calculations. Can take owner’s rmd for year of death.

Source: verlaqkarola.pages.dev

Source: verlaqkarola.pages.dev

Inherited Ira Rules 2025 Perla Kristien, You may have less time to act than you thought. Understanding the tax treatment of distributions and inherited ira rmd rules is crucial for ira beneficiaries.

Source: brittniwtoni.pages.dev

Source: brittniwtoni.pages.dev

New Inherited Ira Rules 2025 Donna Gayleen, Individual retirement account assets are passed to the named beneficiaries, often the person's spouse, upon death. Keep as an inherited account.

Source: www.aaii.com

Source: www.aaii.com

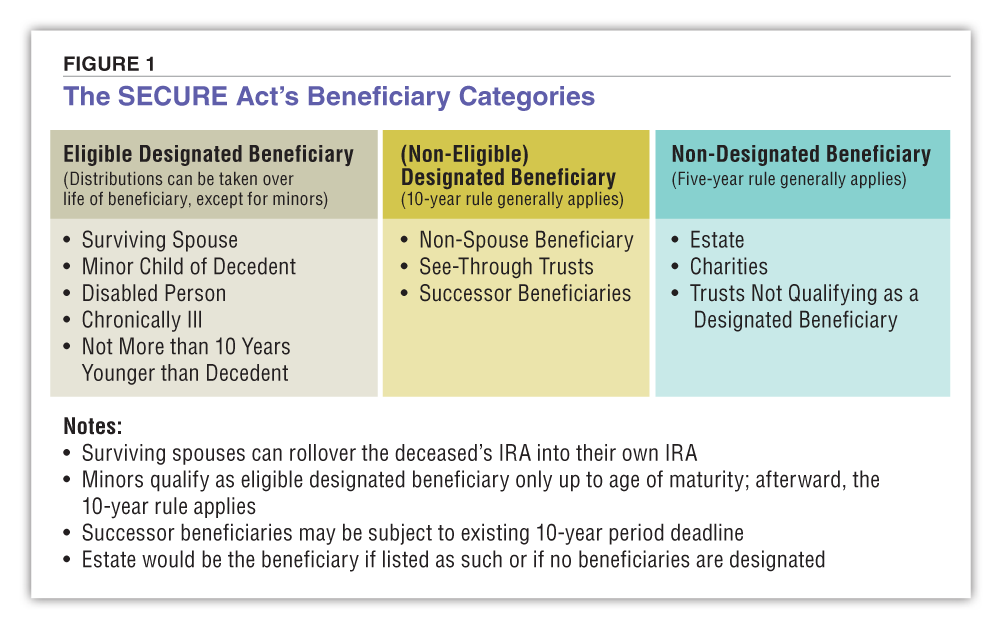

Inherited IRA Rules for Spouses, Heirs and Trusts AAII, If you’re a spouse who’s inheriting an ira, you’ll have two options for transferring that ira to yourself: Spouses who inherit traditional iras can continue to use the stretch ira strategy, basing withdrawals on irs life expectancy rmd calculations.

Source: eveyaauberta.pages.dev

Source: eveyaauberta.pages.dev

Inherited Ira 2025 Rora Wallie, The new rules don’t apply to spouses who inherit an ira—that is a whole different set of rules. If you inherited an ira, and you’re the spouse of the original owner, you have one set of choices.

Source: www.kitces.com

Source: www.kitces.com

Spousal Rollover Rules For Inherited Roth & Traditional IRAs, Section 327 of the secure 2.0 act of 2022 (secure 2.0 act), effective in 2025, which modified internal revenue code section 401 (a) (9) (b) (iv), will provide. The irs issued final regulations for inherited retirement accounts that are set to begin in 2025.

Source: bluehillresearch.com

Source: bluehillresearch.com

Inherited IRA Rules 2025 What Beneficiaries Need to Know, Distributions for 2021 through 2025, and the ira had a 5% rate of return, the. But new rules in the landmark retirement reform dictated that nearly everyone besides spouses would have to withdraw money from an inherited ira within.

Source: julialenore.pages.dev

Source: julialenore.pages.dev

Irs Life Expectancy Table 2025 Inherited Ira Elana Melisa, Reduce beginning life expectancy by 1 for each subsequent year. What if i have inherited a trust or my inherited ira has multiple beneficiaries?

Source: www.youtube.com

Source: www.youtube.com

Inherited IRA Rules and Mistakes to Avoid YouTube, If you’re a spouse who’s inheriting an ira, you’ll have two options for transferring that ira to yourself: A fidelity transition services specialist can help guide you through the process—call us at 800.

Source: www.youtube.com

Source: www.youtube.com

How Do Inherited IRA's Work For NonSpouse Beneficiaries New Rules, Inherited ira rules for spouses. Understanding the tax treatment of distributions and inherited ira rmd rules is crucial for ira beneficiaries.

Individual Retirement Account Assets Are Passed To The Named Beneficiaries, Often The Person's Spouse, Upon Death.

Use owner’s age as of birthday in year of death.

July 20, 2025 At 7:14 A.m.

An inherited ira, also known as a beneficiary ira, is an account that you open when you inherit an ira after the original owner dies.

Category: 2025