Interest Rates For January 2024. The federal open market committee (fomc) announced on january 31, 2024, that it would maintain its policy rate in a range of 5.25% to 5.5%. Where to look, according to economists.

Global headline inflation is expected to fall to 5.8 percent in 2024 and to 4.4 percent in 2025, with the 2025 forecast revised down. It depends on the borrower’s.

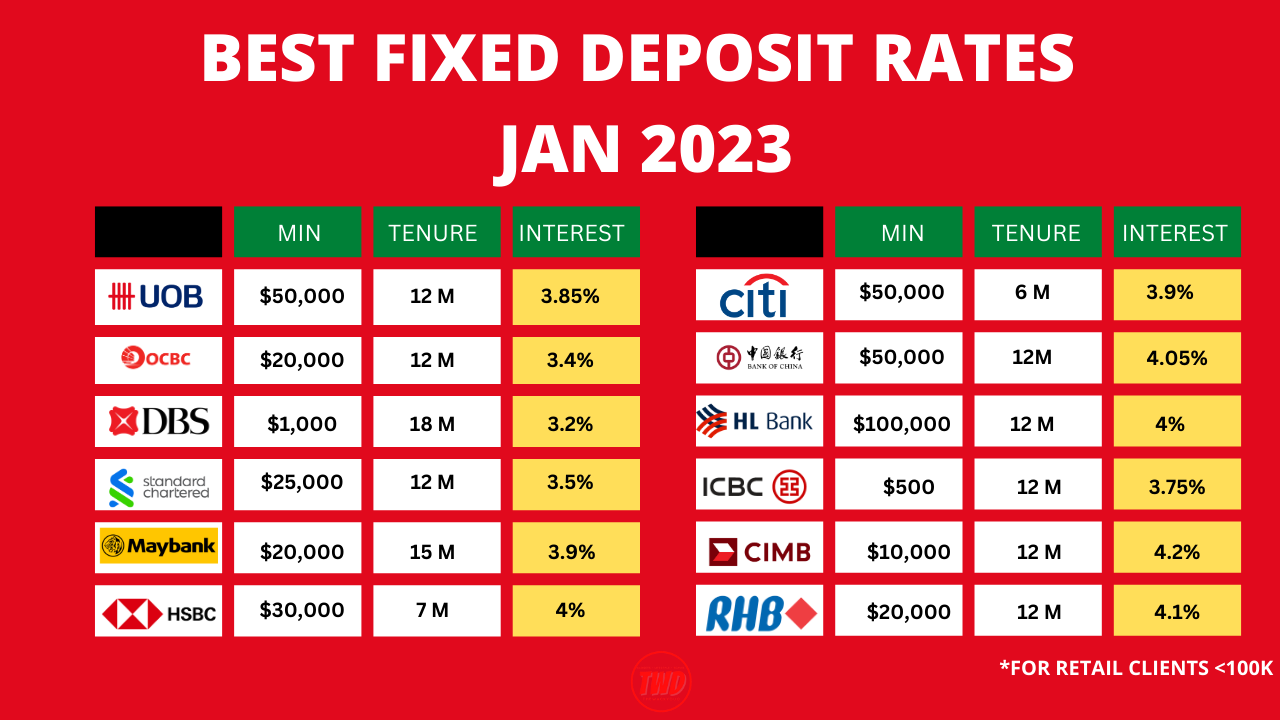

Since The New Year Began, Many Banks Have Revised Their Fixed Deposit Interest Rates And Some Banks Have Extended Their Special Fixed Deposit.

31, 2024 at 6:08 pm est.

A Top Question On The Minds Of Investors And Consumers Alike Is When.

It depends on the borrower’s.

As Regards New Deposit Agreements, The Interest Rate On Deposits From Corporations With An Agreed Maturity Of Up To One Year Stayed Almost Constant At 3.69%.

Images References :

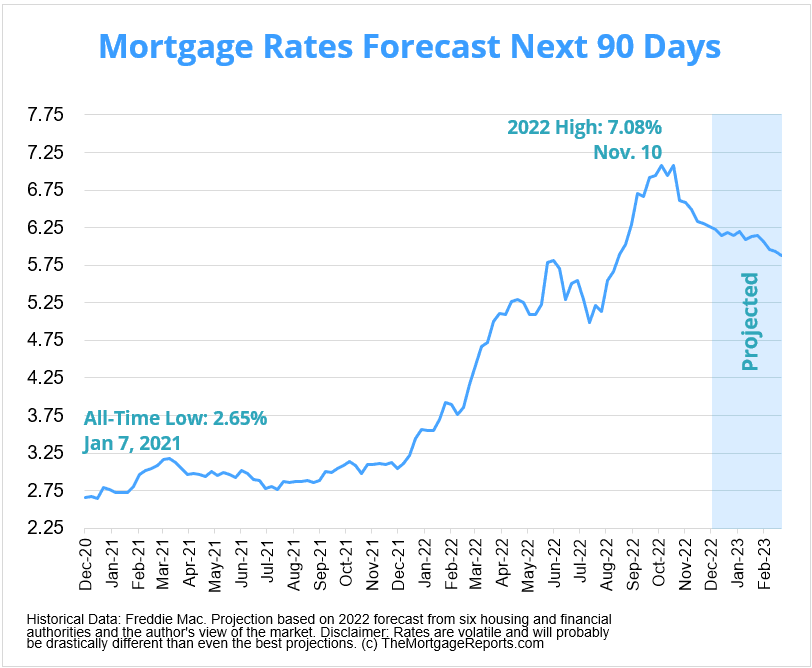

Source: themortgagereports.com

Source: themortgagereports.com

Mortgage Rates Forecast Will Rates Go Down In January 2023?, At its meeting on 25 january 2024, the governing council decided to keep the three key ecb interest rates unchanged. Icici bank according to icici bank's website, their lending rates, effective from march 22, 2024, are as follows:

Source: www.mortgagesandbox.com

Source: www.mortgagesandbox.com

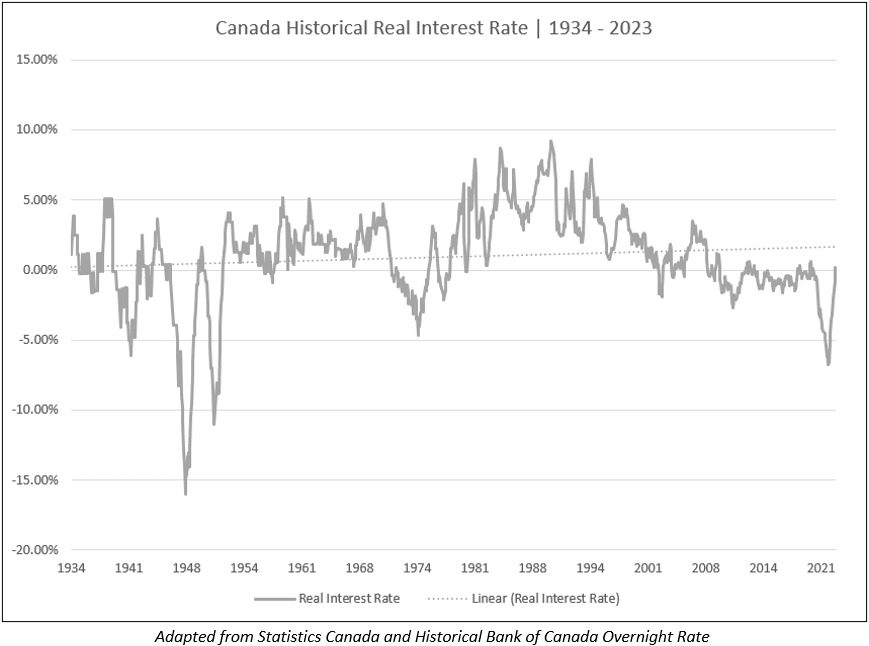

Canadian Mortgage Interest Rate Forecast to 2024 — Mortgage Sandbox, The rate sets a benchmark. After almost two years of jacking up.

Source: moicaucachep.com

Source: moicaucachep.com

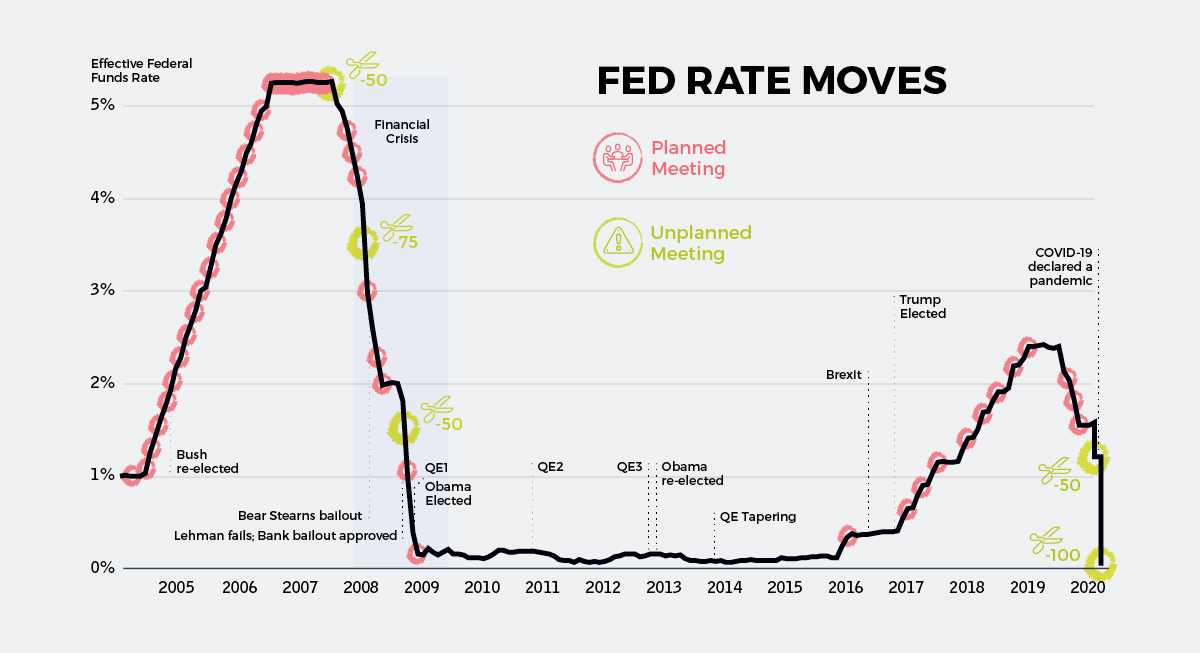

Why Do Mortgage Rates Rise When Fed Cuts Rates Explained, This statistical release contains average interest rates across deposit or loan accounts with uk banks and. This series is intended for use as a.

Source: money.com

Source: money.com

Current Mortgage Rates Interest Rates Drop Money, After almost two years of jacking up. The rate sets a benchmark.

Source: www.simplifyingthemarket.com

Source: www.simplifyingthemarket.com

Where Are Interest Rates Headed This Year? Real Estate with Keeping, The federal reserve's policy committee is widely expected to leave its key interest rate unchanged at its meeting next week. The federal funds target rate has remained at 5.25% to 5.5% since last summer, following 11 increases that began in march 2022.

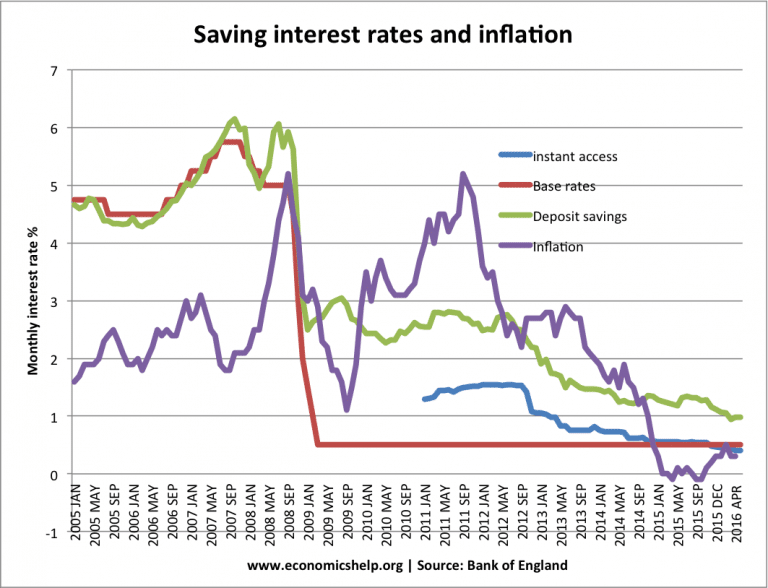

Source: www.economicshelp.org

Source: www.economicshelp.org

Base rates and bank interest rates Economics Help, This statistical release contains average interest rates across deposit or loan accounts with uk banks and. February 14, 2024 / 12:03 pm est / cbs news.

Source: www.homebuyerweekly.com

Source: www.homebuyerweekly.com

Falling Mortgage Rates Should Boost 2024 Home Sales Fannie Mae, Edited by anne marie lee, alain sherter. Read the fed's full january statement here.

Source: helpfulpraise.com

Source: helpfulpraise.com

Best Fixed Deposit Rates Jan 2023 The Wacky Duo Helpfulpraise, It depends on the borrower's. Recent economic data has shown the.

Source: builtplace.com

Source: builtplace.com

Instant Info Bank of England Mortgage Rates BuiltPlace, There are no new alerts at this time. The revised rates will be effective from 1st january, 2024, to 31st march, 2024.

Source: qualityappraisals.ca

Source: qualityappraisals.ca

A Look at Real Interest Rates Quality Appraisals Inc., The specific tenor scheme of “400 days” (amrit kalash) at rate of interest of 7.10 % w.e.f. In addition to extending the deadline for special fixed deposits, some banks have changed the interest rates on their fixed deposits since the.

There Are No New Alerts At This Time.

Latest jobs report signals that interest.

Markets Expect That To Fall By Approximately 1% By The End Of 2024 — As Assessed By The Cme Fedwatch.

After almost two years of jacking up.